Investment Apps: Managing Index Funds and ETFs

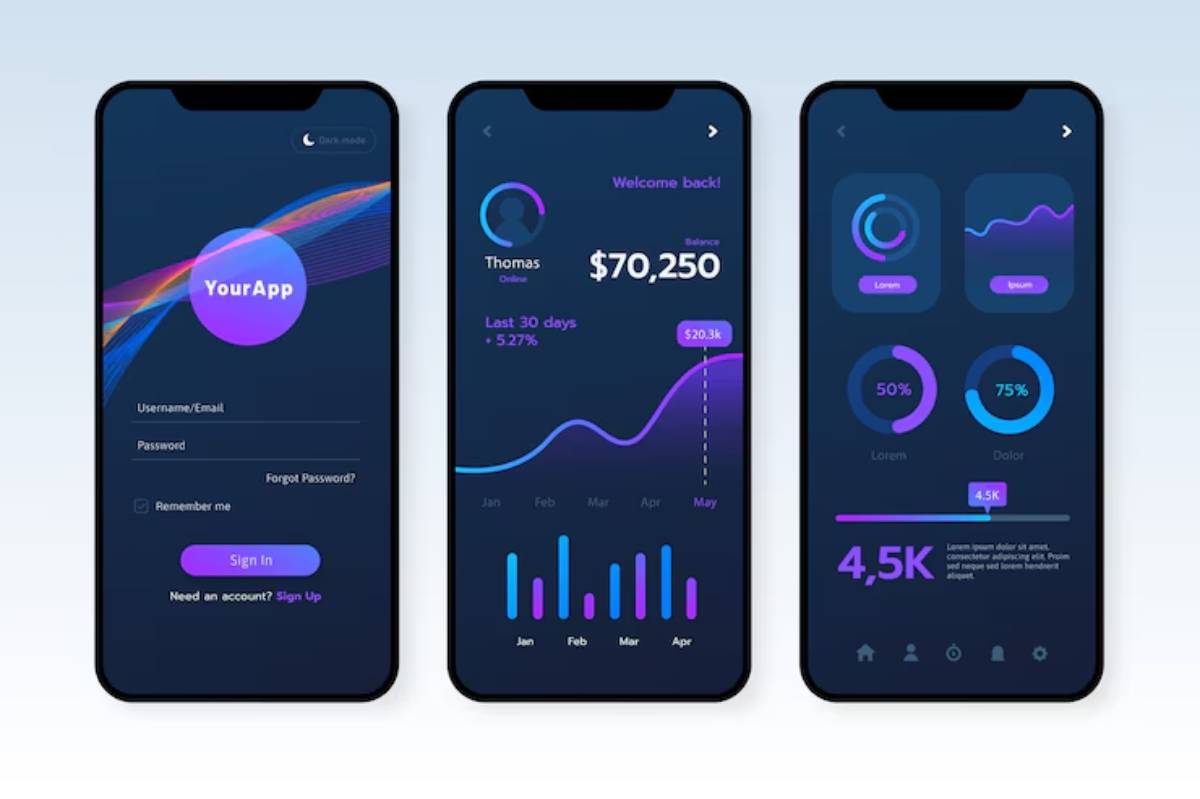

Picture this: you’re sipping coffee in your favourite café, casually glancing at your phone, and in a few taps, you’ve rebalanced your portfolio or topped up your investments.

That’s the magic of investment apps today.

Once reserved for professional traders or desktop warriors, mobile investing has now become mainstream. Thanks to innovative apps, managing index funds and ETFs has never been easier, whether you’re a first-time investor or a seasoned hand.

In this guide, we’ll explore how investment apps work, why they’re transforming portfolio management, which features matter most, and how you can use them wisely to grow your financial future — one tap at a time.

Why Investment Apps Are Booming

1. Accessibility

Apps like Nutmeg, Moneybox, Vanguard, and Freetrade have democratised investing.

- Minimum investments as low as £1.

- Easy account opening processes.

- 24/7 access to your portfolio.

2. Convenience

No paperwork. No need to call your adviser or visit a branch. Everything from rebalancing to adding new funds happens in seconds.

3. Lower Costs

Many investment apps offer low or zero trading fees, particularly for passive investments like index funds and ETFs.

4. Empowerment

Apps give you control over your financial future — even if you start small.

Quick Analogy: Think of investment apps like fitness trackers: they don’t guarantee success, but they make monitoring and improving your performance vastly easier.

Key Features of a Good Investment App

1. User-Friendly Interface

- Simple navigation.

- Clear presentation of portfolios.

- Easy to find, buy, sell, and track investments.

2. Wide Fund and ETF Availability

Look for apps offering a broad range of:

- Index funds (like Vanguard LifeStrategy series).

- ETFs (tracking markets like FTSE 100, S&P 500, MSCI World).

3. Low Fees

Important costs to watch:

- Platform fees (often 0.2%–0.4% per year).

- Fund or ETF costs (Total Expense Ratio, or TER).

- Trading commissions (ideally zero for ETFs).

4. Fractional Investing

Some apps let you buy fractions of shares or fund units, making investing more accessible.

5. Automated Features

- Auto-investing options (monthly top-ups).

- Dividend reinvestment.

- Portfolio rebalancing prompts.

6. Educational Resources

Many leading apps offer articles, podcasts, or webinars to help you grow your investing knowledge.

Popular Investment Apps for Managing Index Funds and ETFs

App & Strengths

Freetrade: Commission-free ETF trading DIY, active investors

Vanguard UK: Low-cost index fund and ETF investing, Long-term passive investors

Nutmeg: Managed portfolios, ethical options. Hands-off investors

Moneybox: Round-ups, auto-savings into index funds

Beginners Trading 212: Fractional shares, wide ETF access, Younger, cost-sensitive investors

Tip: Choose based on what suits your style — simplicity, control, automation, or a mix.

How to Manage Index Funds and ETFs on an App

1. Set Clear Investment Goals

Before tapping “Buy”:

- Are you investing for retirement, a house, or general wealth building?

- What’s your time horizon?

- How much risk can you genuinely tolerate?

Tip: Most apps will guide you through a questionnaire to help.

2. Build a Diversified Portfolio

Start simple:

- A global index fund (e.g., FTSE Global All Cap Index Fund) for worldwide equity exposure.

- An emerging markets ETF for additional growth.

- A bond fund to temper volatility if you’re more conservative.

3. Automate Contributions

Set up monthly direct debits into your ISA, SIPP, or GIA through the app.

- Removes the temptation to “time the market”.

- Builds discipline and consistency.

4. Rebalance Periodically

Markets shift your allocations over time. Apps often prompt you when it’s time to rebalance back to your original targets.

Example: If equities boom and you end up with 80% stocks instead of your intended 70%, you’ll need to sell some and buy bonds to restore balance.

5. Monitor, But Don’t Obsess

It’s easy to check your portfolio daily — but resist the urge.

Better habit: Review your investments quarterly or bi-annually, not daily.

Rhetorical question: Would you dig up a tree every day to see if it’s growing?

Real-World Story: How Alex Used an Investment App

Alex, a 28-year-old teacher, was tired of saving into a low-interest savings account.

- He downloaded Moneybox.

- Started rounding up his purchases (58p here, £1.24 there) into a Stocks and Shares ISA.

- Chose a medium-risk portfolio made up of index funds and ETFs.

- Over two years, with round-ups and a £50 monthly contribution, Alex built a portfolio worth over £4,500.

Key Takeaway: Small, consistent actions add up — especially when automated.

Common Mistakes to Avoid with Investment Apps

1. Overtrading

Apps make buying and selling easy — sometimes too easy.

Advice: Stick to your long-term plan. Don’t chase trends or panic sell.

2. Ignoring Fees

Even “low-cost” apps can have hidden charges. Always check:

- Fund TERs

- Platform fees

- Exit fees (if any)

3. Risking Too Much

Just because investing feels easy doesn’t mean risk disappears:

- Understand what you own.

- Stay diversified.

- Match your risk to your actual goals.

4. Neglecting Emergency Savings

Before investing heavily, ensure you have 3–6 months’ living expenses in a safe, accessible account.

Robo-Advisors vs. DIY Investment Apps

Feature Robo-Advisors (e.g., Nutmeg) DIY Apps (e.g., Freetrade, Vanguard) Who picks the portfolio? Robo-advisor algorithm You Effort Required Minimal Moderate Fees Slightly higher (~0.3–0.75%) Lower (~0.1–0.3%) Customisation Limited Full control

Summary: If you want simplicity, robo-advisors shine. If you want maximum control, DIY apps give you the tools.

Key Takeaways

Like any tool, success comes from how you use it:

- Stay disciplined.

- Think long-term.

- Focus on costs.

- Keep learning.

Investing on the Go, Growing for Life

Investment apps have truly levelled the playing field.

Today, whether you want to build a global portfolio, invest your spare change, or actively manage ETFs, you can do it — from the palm of your hand.

Ready to start your investing journey? Download a trusted investment app today, set your first goal, and take the first empowering step toward building a stronger financial future.

Did this article help you feel more confident about managing your investments on the go? Leave a comment, share your app experience, or subscribe for more easy-to-follow investing guides!